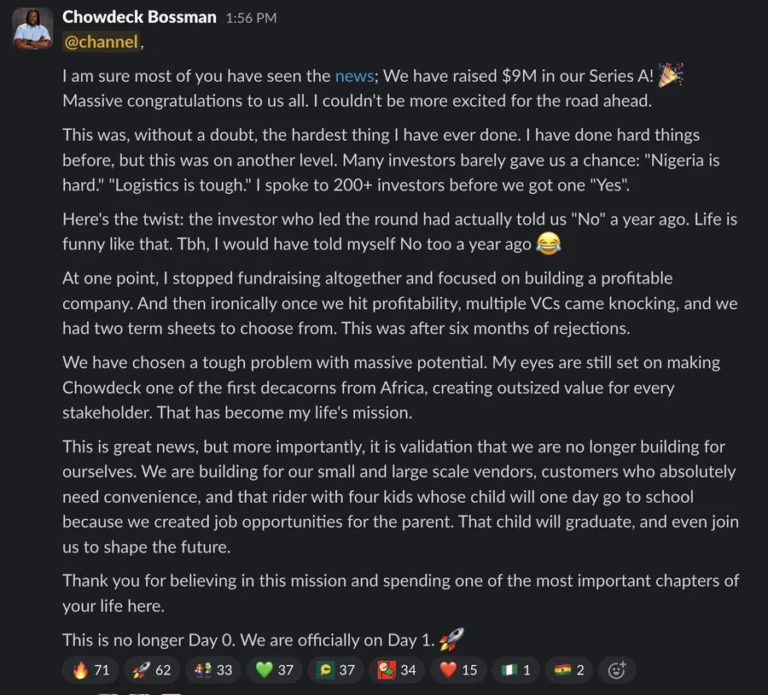

Nigerian food delivery platform Chowdeck announced its $9 million Series A in August — one of the largest fundraises for a local African food delivery player to date.

It’s a big deal in a globally challenging sector and the stakes are high.

In recent months, Jumia Food, Bolt Food, and others have exited Nigerian and African markets, citing “challenging economics” and operational difficulties.

"The economics are tough in this market because the costs are very high and there is plenty of competition so there is downward pressure on the commissions that we make and upward pressure on marketing costs because everyone is fighting for customers."

— Jumia CEO Francis Dufay pic.twitter.com/QuWiXjRSED

— Afridigest ???????????????????? (@AfridigestHQ) December 16, 2023

Yet Chowdeck claims profitability, having scaled to 1.5 million customers and 20,000+ riders in 11 cities across Nigeria and Ghana.

That growth comes against a backdrop that should theoretically kill convenience spending. Consumer purchasing power has eroded drastically across Nigeria as the price of staple foods and essential items like petrol has skyrocketed.

Yet paradoxically, food delivery in Nigeria grew at a nearly 200% CAGR between 2021 and 2024, reaching ₦50-70 billion in GMV annually according to Paystack, the leading payment processor for companies in the space.

So how was Chowdeck able to ride that wave while Jumia Food drowned?

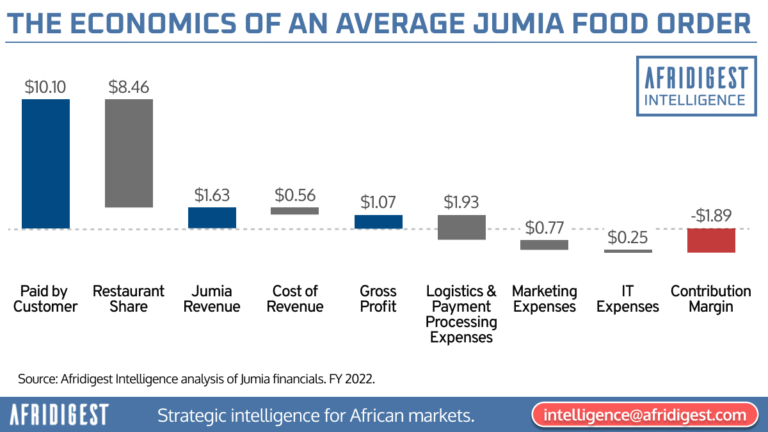

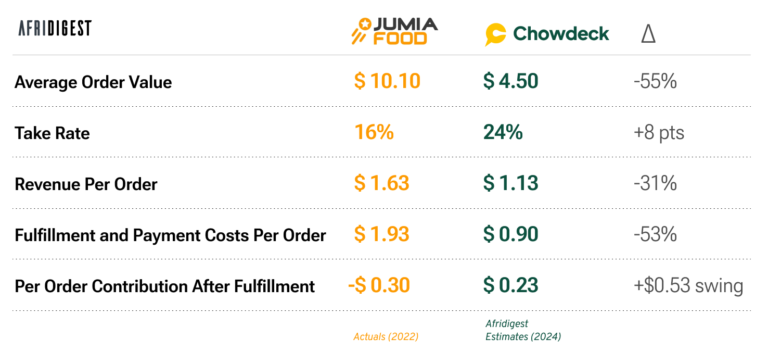

My analysis of Jumia’s financials last year revealed brutal unit economics for the company’s food delivery business:

The math was simple — and devastating:

- Average customer payment: $10.10

- Jumia’s revenue per order: $1.63 (16% take rate)

- Fulfillment costs alone: $1.93

- Net contribution margin: -$1.89 per order

Jumia Food lost money on every single order, with fulfillment costs exceeding total revenue. Even without accounting for marketing, technology, and overhead costs, the business was fundamentally broken.

Sure, the food delivery unit processed 11 million orders and $115 million in GMV in 2022, but every order deepened the parent company’s losses.

I spoke about Jumia and why the company killed Jumia Food on the BBC’s Focus on Africa podcast (12/22/2023) — the Jumia Food question comes at the 4:55 mark.

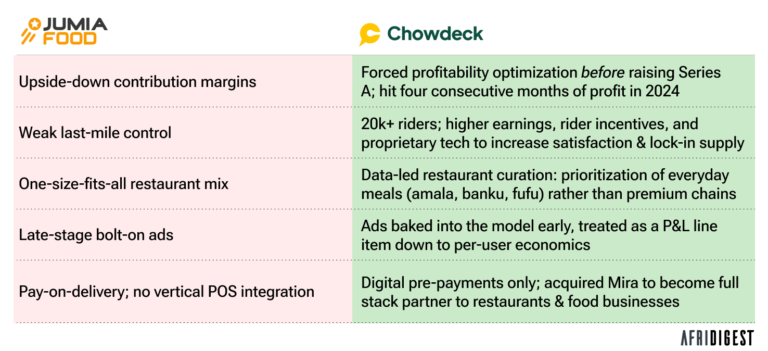

Why Jumia Food’s fulfillment costs were so high

At a high level, certain structural factors likely drove Jumia Food’s fulfillment costs:

- Infrastructure mismatch: Jumia’s logistics system was designed for e-commerce parcels, not on-demand food delivery. So the features that are ideal for food logistics — ultra-high-density delivery zones, short-haul routing, route clustering, sophisticated geotagging, demand forecasting, etc. — were underdeveloped or missing entirely, leading to inefficient resource allocation.

- Internal dynamics: When standalone food delivery platform HelloFood rebranded to Jumia Food and came under the Jumia umbrella in 2016, it was seen as a customer acquisition engine for Jumia’s main e-commerce business and a driver of top-line sizzle rather than bottom-line steak. This perception drove misaligned incentives and allowed poor unit economics optimization to fester until the company’s founding CEOs were fired.

- Poor market timing: Jumia Food launched in 2012 when Nigeria’s digital payment infrastructure was nascent. They had to accept cash on delivery and spend heavily on user education — costs that Chowdeck and other platforms in the post-Jumia Food generation can avoid. (“The single most important factor in a startup’s success is timing.”)

Local context as a competitive advantage

Chowdeck’s founding team argues that something else was at play: Jumia and others with similar food delivery models were solving for the wrong market.

While Jumia Food focused largely on pizzas and burgers — foods Nigerians might order weekly or monthly — Chowdeck targeted what people actually eat daily.

“No one eats pizza every day. Nobody eats burgers every day,” Aluko explained on a recent podcast. “But delivering amala, delivering jollof rice — that’s different. That’s what people eat every day.”

That insight drove Chowdeck to onboard local ‘bukkas’ — roadside restaurants selling traditional Nigerian food.

While it required significant technology customization — e.g., SMS-based order notifications for vendors without smartphones — it created sustainable, high-frequency demand.

That said, nothing stops well-funded competitors from copying this bukka strategy in theory. Looking forward, the real test will be whether Chowdeck’s first-mover advantage in traditional vendors creates lasting loyalty, or whether restaurants will multi-home across platforms as competition from Glovo and others intensifies.

The infrastructure advantage: Standing on the shoulders of giants

You can’t ‘leapfrog’ without the base to leapfrog from

You can’t have asset-light models if the assets don’t already exist

You can’t build a digital economy without physical infrastructure underneath

— Emeka Ajene ✍???? (@eajene) January 21, 2025

Chowdeck launched into a fundamentally different ecosystem than Jumia Food encountered in 2012.

As one analyst noted, they got to play “delivery on easy mode” — not because the business became easier, but because various forms of critical infrastructure had been built by predecessors:

- Digital payments: Where Jumia, Konga, and other early e-commerce players had to accept cash payments and educate users about digital transactions, Chowdeck launched requiring users to pay digitally. Paystack reports that digital payment adoption for food delivery now exceeds 95%.

- Smartphone penetration: Nigeria’s smartphone adoption crossed critical mass, with over 40% broadband penetration by 2021, versus minimal smartphone usage in 2012 when Jumia Food launched as HelloFood.

- Delivery culture: The COVID pandemic normalized delivery services across the world, including Nigeria. Moreover, Players like OPay pursued blitzscaling strategies — selling meals for as low as ₦100 with free delivery — effectively subsidizing market education for future entrants like Chowdeck.

- Logistics infrastructure: A network of couriers, financing options for motorcycles, and established vendor relationships already existed when Chowdeck launched. Moreover, motorcycle taxi bans in cities like Lagos created pools of available riders actively seeking alternatives.

X for Y: Chowdeck for Africa

It’s inevitable that Chowdeck will be the DoorDash for Africa. https://t.co/l5NMVOBP2S

— Aaron Epstein (@aaron_epstein) August 12, 2025

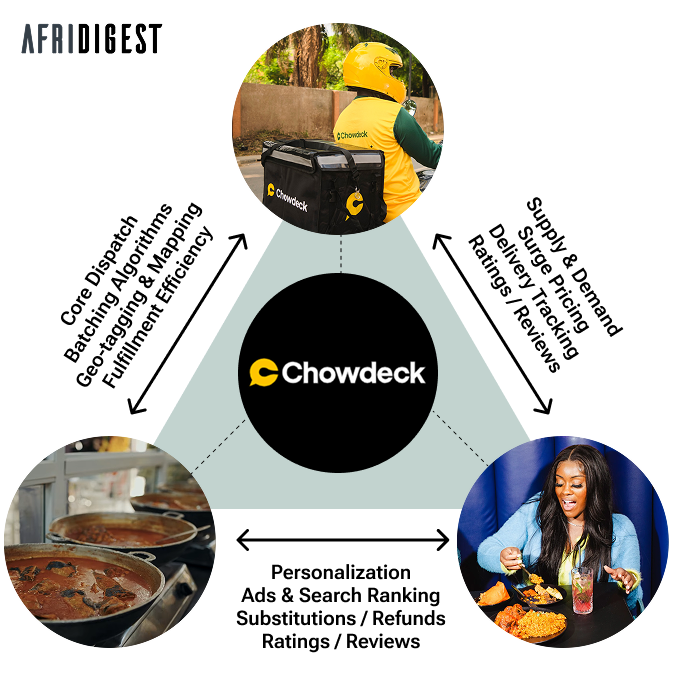

Chowdeck’s three-sided marketplace

While Jumia Food was an example of a two-sided platform attempting to navigate the three-sided market of on-demand delivery, Chowdeck has been fully focused on the three sides of the market from day one: riders/couriers, restaurants/vendors, and customers.

In general, shifting from a two-sided to a three-sided marketplace is strategically tricky as it adds cost, complexity, and competing incentives:

- Customers want low prices and speed

- Couriers/riders want high earnings and flexibility

- Restaurants/vendors want low commissions and volume

At the same time, trade-offs around which side of the marketplace to favor become more difficult, since optimizing for one side usually comes at the expense of another.

For example:

- Pushing vendors to offer in-store prices delights customers but upsets restaurants who have to pay platform commissions.

- “Batching” multiple customer orders into one courier trip means higher courier earnings but longer customer wait times.

- Reducing commissions means more revenue for restaurants, but can undermine courier economics as platforms have less margin for incentives.

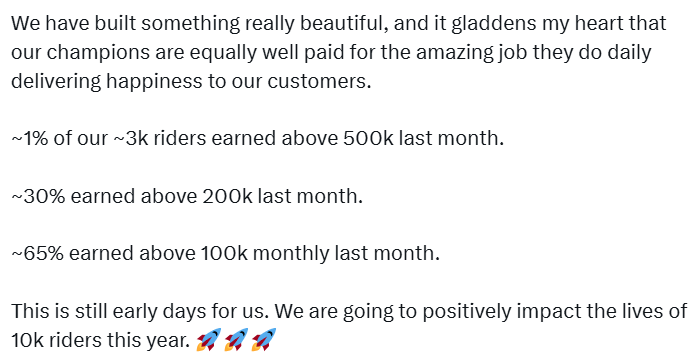

For Chowdeck, which has been a three-sided platform since inception, couriers are the north star.

The company sees its delivery fleet as its core asset as it builds a hyper-local, last-mile system that reaches beyond high-end restaurants and customers to serve the masses.

In doing so, it’s creating network effects that may prove difficult for others to replicate.

CEO Femi Aluko on Chowdeck’s courier focus:

Cracking the courier code

“[Riders] want more money, they want more orders, they want deliveries… That’s the constant theme across what riders really want. So we started optimizing our processes, optimizing our operations around that.” — Chowdeck CEO Femi Aluko

With 30,000+ daily deliveries concentrated in dense zones, active Chowdeck couriers report making ₦35,000 – 70,000+ (~$25-50) a week regularly.

Chowdeck courier incentives:

- Monthly food allowance (e.g., ₦10,000 for 300+ deliveries)

- Weekend bonuses (e.g., ₦5,000 for riders who work Sundays)

- Housing support and promotion opportunities

- Average earnings for entire fleet: ₦100,000-200,000 ($65-$130) monthly — 1.5-3x Nigeria’s revised minimum wage

This isn’t altruism. High courier incentives necessitate higher delivery and service fees, lower marketing spend, and lower vendor subsidies.

But higher courier pay leads to less churn and better service.

And assuming a $4.50 AOV and a 25% take rate, a productive courier generates upwards of $400 monthly in revenue for Chowdeck, with one-time driver acquisition costs of perhaps $50-100 in recruitment, training, and onboarding.

Notably, the economics become even more compelling over time as word spreads and courier recruitment costs plummet.

One of our estate security guys quit to go and become a Chowdeck rider, now he’s just always smiling whenever I see him. ❤️????

— Name cannot be blank (@hackSultan) August 12, 2025

Chowdeck’s growth engine

In addition to prioritizing courier economics and focusing on high-frequency, lower cost local bukkas, these additional strategic pillars underpin Chowdeck’s success:

Technology-driven operational excellence

Chowdeck deploys a suite of purpose-built technical infrastructure:

- Advanced geotagging: Chowdeck developed its own geotagging function to predict the number of riders needed at any given time at a specific location. “We utilize flexible geotagging so our riders can serve restaurants within an allocated radius,” — Femi Aluko.

- Custom mapping technology & route optimization algorithms: Chowdeck built its own mapping solution using OpenStreetMap because “Google Maps was not accurate enough” for their needs in Nigeria. This customization is now critical for operational efficiency.

- Data-driven scaling: Every new city and dark-store location in the Chowdeck network is chosen by data, not intuition. Moreover, the company uses in-house data for supply assessment and real-time demand forecasting. If they anticipate 3,000 deliveries in a zone and know the average courier there completes eight deliveries daily, they can ensure at least 375 riders are available.

- Customer loyalty engine: The Chowdeck Score (or ChowScore) awards free delivery and other vouchers to customers based on usage; churn among customers with the highest ChowScores is a fraction of that of other users.

- Dynamic pricing: Chowdeck implements surge pricing during periods of high-demand (e.g., days with heavy rainfall) to incentivize drivers to balance the supply-demand ratio.

@chowdeck why is delivery surge fee 4 times the price????

HAAA!!!! pic.twitter.com/fvqy45lPWA— Osime (@oosimee) July 6, 2025

A repeatable expansion playbook

Chowdeck currently operates in 11 cities — 10 in Nigeria and 1 in Ghana. The company’s Accra launch is illustrative.

Chowdeck hit 1,000 daily orders within three months without paid advertising by focusing on fufu and banku, foods Ghanaians eat daily.

Two weeks later, Chowdeck doubled to 2,000 orders daily in the city. It’s strong proof that the model works outside of Nigeria.

Multiple revenue streams

Chowdeck’s multi-vertical approach relatively early in the company’s lifecycle not only offers diversification — creating layered revenue streams rather than a single burn-heavy food-delivery play — it spreads fixed costs as well.

In addition to food delivery, the company generates revenue from:

- Grocery delivery from local markets — a continuation of the strategy to pursue more affordable, higher frequency orders

- Grocery delivery from formal supermarkets like Shoprite and Spar

- Deliveries from pharmacies, liquor stores, and other shops

- A package delivery business

- A membership subscription business

- An ads business

- A vertical SaaS business — in addition to this new revenue line, the acquisition of POS platform Mira (which already powers 4,000 restaurants) allows Chowdeck to deeply integrate with client restaurant’s core operations (i.e., inventory, sales reporting, payments), creating stickiness, locking out competitors, and providing valuable data to further optimize delivery times and demand forecasting.

- Quick commerce — ultra-fast delivery (27 min average pick-up-to-door time today; target 20 min) backed by a network of dark stores; Chowdeck plans to deploy 40 dark stores by end of year 2025, and 500 by EOY 2026.

With a delivery fleet as its core asset, Chowdeck is building a hyper-local, multi-vertical commerce and logistics network (or super app) — with food as its initial, dominant wedge.

“We’re thrilled about this [Series A] round as it brings us closer to our vision of becoming Africa’s number one super app.” — Chowdeck CEO Femi Aluko

Other delivery options and courier services are a logical evolution from food delivery. In much the same way ride-hailing apps become super apps, these services leverage the existing driver/courier network for new use cases, improving asset utilization and service provider earnings while creating new revenue streams. The driver/courier who delivers your lunch can also deliver your package, making the entire system more efficient and defensible.

Interestingly enough, Chowdeck’s path to becoming a super app inverts the traditional playbook. When I was at Gozem, for example, we built out our driver fleet across two-, three-, and four-wheeled vehicles for ride-hailing before adding higher-margin food delivery during COVID. But Chowdeck is taking the reverse approach — building its driver fleet with food delivery and expanding from there.

Conventional thinking says that the higher the frequency of usage, the more likely an app is to successfully become ‘super.’ While you might order a motorcyle taxi twice a day or more, the average person likely doesn’t order food that often — at least not under the Jumia Food model. But with Chowdeck’s focus on vendors that offer affordable, everyday foods, customers may order daily or at least multiple times a week, creating the habit loop and stickiness that super apps thrive on.

In any case, the convergence is revealing: whether starting from mobility (like Gozem or Gojek) or food (like Chowdeck or Meituan), successful super app platforms reach the same conclusion — whoever owns the most productive driver network wins.

That said, dark stores may be the clearest signal of Chowdeck’s multi-vertical super app ambitions. The potentially ubiquitous dark store network creates physical infrastructure that’s difficult for competitors to replicate quickly. Each location becomes a hyperlocal fulfillment center that can serve multiple verticals — food, groceries, pharmacy, even financial services.

Multiple revenue streams create natural pathways to financial offerings. With millions of transactions flowing through the platform and relationships with couriers, merchants, and consumers, Chowdeck is positioned to capture embedded lending opportunities in markets with virtually unlimited appetites for credit.

Banks in sub-Saharan Africa — with the exception of Southern Africa — don't really lend to the private sector

But the appetite for credit is virtually unlimited in the region

So non-bank lending solutions are particularly important

Here's a quick overview from @AfridigestHQ pic.twitter.com/bi7Iet4bKY

— Emeka Ajene ✍???? (@eajene) September 21, 2023

In addition, Chowdeck, with ~11M in annualized orders, already generates a massive amount of data about consumer behavior, logistics, and market demand — data that can be used to shrink unit costs and increase defensibility in today’s AI age (e.g., dynamic batching & routing for couriers, menu insights and ad performance automation for restaurants, personalized search and recommendations for customers). This data becomes increasingly valuable and differentiating as the platform scales.

Chowdeck’s positive unit economics

Having examined Jumia Food’s financials above, let’s look at how Chowdeck fares in comparison.

The contrast is striking:

- Average order value: $4.50. The 55% decline in AOV relative to Jumia Food is the outcome of selling amala and jollof rice to the masses instead of pizza and burgers to elites.

- Take rate: 24%. Chowdeck sacrificed order size for order frequency. And with customers ordering multiple times per week rather than once per month, Chowdeck has become a reliable, high-volume sales channel for restaurants; thanks to this volume and the reliability of additional demand, the company can justify a premium.

- Revenue per order: $1.13. While Chowdeck’s AOV is less than half of Jumia Food’s, the difference in revenue is somewhat muted (-31%) as a result of Chowdeck’s 50% higher take rate.

- Fulfillment costs: $0.90. Where Jumia’s logistics were built for long-haul, irregular parcels, Chowdeck’s system is engineered for ultra-high-density, short-haul delivery. Close to 90% of orders are short-distance, minimizing rider downtime and maximizing deliveries per hour — perhaps the single most important metric for on-demand delivery unit economics.

- Net contribution after fulfillment: +$0.23 per order. A $0.53 improvement over Jumia Food’s $0.30 per order loss after fulfillment — the difference between business model viability and cash incineration.

Chowdeck’s positive contribution after fulfillment (before accounting for marketing, technology, and overhead costs) provides the foundation for sustainable growth that Jumia Food never achieved. While each transaction generates less revenue in absolute terms, the business actually works — it’s not ‘losing money on every order and making it up in volume.’ Still, it’d be interesting to know the company’s customer acquisition costs and/or marketing spend efficiency to paint a fuller picture.

“We took the time to figure out the right economics for our delivery business. This approach kept us focused on selling and targeting the right customers rather than trying to capture everyone.” — Chowdeck CEO Femi Aluko.

The road to $1 billion

“We think we have a decent understanding of our product — the things we want to continue to double down on and continue to build. That’s what Day One means to us: now we have something and we’re pushing hard. We’re going hard. We’re going all in. Taking big bets, big risks, and trying to build Africa’s next unicorn and eventually decacorn.” — Chowdeck CEO Femi Aluko.

With $9 million in fresh funding and solid unit economics, Chowdeck targets ambitious — perhaps unfeasible — milestones:

- 1 million deliveries per day within three years

- 60 million Nigerian users (~30% of the population)

- Continental expansion beyond Nigeria and Ghana

- Evolution into Africa’s first food delivery unicorn

- Evolution into a $10 billion decacorn from Africa

The company’s execution to date has been impressive, and growing to 30,000+ daily deliveries while maintaining profitability demonstrates the scalability of its approach.

Still, there are legitimate questions about the addressable market size and market penetration limits in Nigerian cities, and there are significant risks. Perhaps the biggest of which is the company’s foray into ubiquitous dark stores.

Chowdeck has made great strides with asset-light marketplace operations since launch, but dark stores require massive capital investment. Can the company maintain unit economics while building and managing operationally complex infrastructure?

Moreover, if purchasing power in Nigeria continues to erode, at what point does convenience become unaffordable, even with perfect execution?

Implications

Whatever the future holds for Chowdeck, the company’s journey illustrates several principles for those building in African markets:

- Infrastructure first: In markets with infrastructure deficits, building the missing pieces (dark stores, logistics networks) and hybrid offline-online systems generally creates more defensible businesses than pure software plays.

- The tension between unit economics & growth: Optimizing for profitability from day one tends to slow initial growth, but does it create more sustainable venture-scale opportunities over the medium term?

- Applied local insights can beat global capital: Upstarts that use deep market understanding to inform their strategy can outcompete better funded competitors who lack or fail to act on contextual insights.

- Diversification enables scale: Early diversification — across revenue lines (and geographies) — may create more resilient business models in African markets than single-revenue/single-market approaches.

Conclusion: The second mouse gets the cheese

Chowdeck is proof that sometimes the second mouse gets the cheese.

By standing on the shoulders of predecessors and learning from their mistakes, the company created a food delivery juggernaut.

Chowdeck’s strategic pillars — superior rider economics, a focus on high-frequency local vendors, tech-driven operational excellence, a proven expansion playbook, and a diversified revenue approach — address the specific challenges that killed previous players while enabling sustainable competitive advantages.

Chowdeck’s next phase will test whether its pre-Series A success can scale across Africa and multiple new verticals. If the company can launch dark stores in four hours while maintaining 30-minute delivery times at ~20% take rates, it’s likely to become a critical piece of the continent’s logistics infrastructure.

Where Jumia Food relied on systems designed for e-commerce parcels, Chowdeck built a profit-first, diversified yet integrated food-and-logistics engine whose operating model and courier-centric culture give it the unit-level margin strength to scale where others burned out.

Sometimes the second mouse doesn’t just get the cheese — it gets the whole kitchen.

Afridigest’s advisory arm Afridigest Intelligence helps executives, investors, and institutions create and capture opportunities across African markets through strategic intelligence, analysis, and insight. Contact intelligence@afridigest.com to see how we can help.

Share: